About us

Whales are the biggest creatures in the Oceans, and it’s no different in the cryptocurrency sphere. The label applies to people or entities that hold or hodl the largest amount of crypto. A Bitcoin whale usually refers to a single wallet address with over 1000 BTC. However, people owning large amounts of other cryptocurrencies can be referred to with the more general term “crypto whale”.

There are many trading maneuvers whales use to profit, like using a trading tactic commonly called the ’rinse and repeat cycle.’ The rinse trade is used in many types of markets and can be effective if timed correctly and very profitable if you are a bitcoin whale. The trader with a lot of holdings starts selling bitcoins lower than the market rate which at times can cause a panic sell off by small-time traders. The trick is the whale sold just below the current market value and just enough to watch panic ensue. Then the whale waits and watches the panic selling take place until the bitcoin price reaches a new low. At this point, the whales quickly scoop up way more bitcoins than they first started with and after the ‘rinse’ they usually ‘repeat’ this type of trade often. People speculate that there are many ways whales can throw their ‘BTC weight’ around to either push the price up or down to accumulate more bitcoins. Further, whales are not just individuals and can be an organization like a bitcoin investment fund as well.

The value of crypto coins is determined by and large through supply and demand. Meaning, if a large portion of the supply of a particular coin is held out of circulation, this drives up the price of the coins left in circulation. It follows that if a large number of coins are suddenly liquidated, the value of those coins will drop. Because of this, supremecapitaltraders.com have the unique ability to essentially manipulate the crypto market for their benefit.

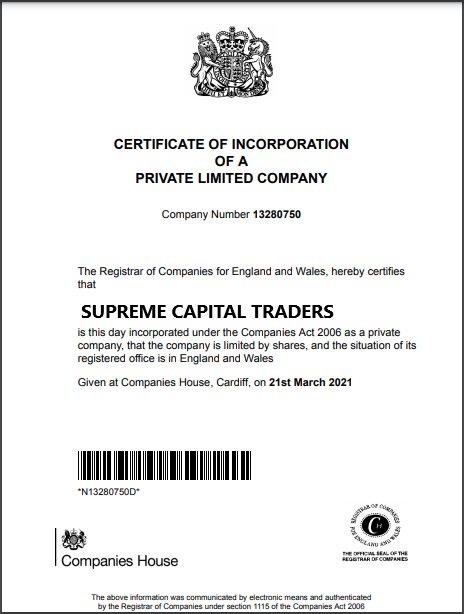

supremecapitaltraders.com LTD

Company number 13280750

supremecapitaltraders.com is an officially registered company operating within the framework of international financial legislation, which ensures protection of our users both from the legal and financial side.

Large bitcoin holders are called whales because their movements disturb the waters that smaller fish swim in. Following the 80-20 rule (also known as the Pareto principle), the top 20% of bitcoin holders have more than 80% of bitcoin value in U.S. dollars. According to BitInfoCharts, just three bitcoin wallets owned 7.18% of all the bitcoin in circulation as of Q1 2021 with a value of just around $74 billion, and the top 100 wallets held around one-third of all bitcoin at a valued at $342 billion.

$375324167

Executed Trades13733

Total Customer$840786428

Total Payouts

Our simplified approach

The history of our company starts in the very beginning of the XXI century. In the 2000s, the appearance of new technologies gave a powerful impetus to the development of exchange trading and innovative types of investments. Along with the global spread of affordable Internet and mass production of personal computers, many experts have come to the conclusion that brokerage and trust asset management can also be brought online.

Since we started in 2015, we made sure that our clients do not have to worry about any legal issues. You don’t need to go through bureaucratic red tape (which may be quite brutal sometimes) in order to participate in our program, and we pay all associated fees and penalties from the reserve fund of the company.

We Deliver Our Services Few Process

Distinctively grow your fund using our simplified earning methodology. You can't get it anywhere better!

Fund your account

Fund using any of the available funding system.

Activate a trading plan

With your account fund, you can easily activate a trading plan.

Get paid

You will receive payment on each cycle based on the plan selected.